[SC] – Making the DAO own Liquidity on DEXes – Governance Meta – API3

I promised this Sentiment check a while ago, but unfortunately i had a little bit of a forced break through COVID after Paris.

Essentially, i am of the firm belief that we have a slight liquiditiy issue that makes it very difficult for a lot of people to become part of the DAO.

How am i coming to this conclusion?

Let’s take the current voting power threshold required to create a proposal. With about 46M API3 staked, it takes 46000 staked API3 to have enough voting power to create a proposal.

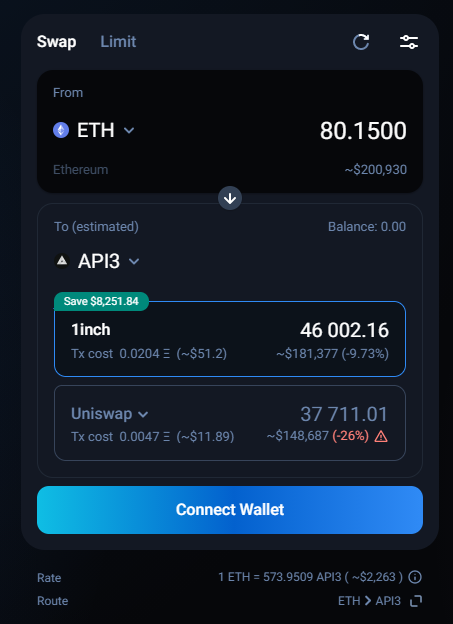

image453×624 47.2 KB

image453×624 47.2 KB

Going to an aggregator like 1inch, directly shows us the problem at hand. At current prices, aquiring enough API3 to gain “proposal creation rights” costs you about 200k USD. I don’t have an issue with that number per se and i think its a good limiter to filter out unnecessary proposal creations. What i do have an issue with is that aquiring this amount of API3 will make me loose 10% of it to slippage. As the above example shows, i will have to pay 200K USD~ to get out about 181K worth of API3.

This does not even factor in that scaling out of API3 will again cost me about 9-10% in slippage, further diminishing my initial holdings. If we take an extreme example, where i would buy 46k API3 and straight up sell it again, my initial 200k would be worth about 164k, which is a 36k direct loss, just for scaling in and out of API3.

This example should make it blatantly obvious why a lot of people simply cannot affort or don’t want to bother with getting involved with API3 in any way. I have dealt with this personally, where friends are asking me if there is a way for them to scale into API3 without moving the price by double digit % points for “ridiculously low” amounts they want to buy and i always have to tell them, they could try OTC, which is hard when nobody wants to sell.

It would be in the DAOs best interest to increase liquidity and actually also own that liquidity because:

-

it would make it easier for new members to be attracted to the DAO

-

future insurance payouts (that will probably be made in API3), would be worth a lot more if 10-25% of it isn’t lost to slippage, making the insurance product even more attractive to potential customers

-

Owning liquidity would create income for the DAO in forms of liquiditiy provision fees and possibly even further incentives depending on which DEX is used.

Now the issue that we as the DAO face is, that we have an incredibly large amount of API3 and also some USDC, but no ETH. I am of the strong believe that our USDC reserves should not be touched and only used for grants towards initiatives, because otherwise we’ll run into the situation where we have nothing but API3 to pay for salaries, which ultimately will mean, we would need to sell API3 to pay people.

With the USDC out of the equation, we’re left with API3 and we’re missing ETH in order to LP either on Sushiswap or Uniswap. The only solution we have here is to sell some of our API3 into ETH, similar to how e.g. Lido did it. The approach of selling DAO owned API3 also makes the most sense, because the DAO cannot stake its own treasury, which means that it is loosing value each week where inflationary rewards are paid out. So selling some of the treasury, to make up for our need for ETH is a logical approach.

The questions that come up however are:

- Who do we sell it to? (Value add to the DAO, with the exception of ETH?)

- What are the conditions? (Price, Vest, Cliff, can they vote?)

- How much are we willing to part ways with? (In API3)

Considering Point 1:

A lot of people would want to go the VC route here. They have the money yada yada. Personally, i’m not really a big fan of it. Looking at our current portfolio of VCs we have significant VCs covered already. Is another Crpyto VC really going to add any more “exposure” that benefits us as a project? Is the little amount of exposure we’d gain worth things like a) giving another VC voting power or b) giving them a discount on market value?

Considering Point 2:

What price are we selling for? Is there a vest & a cliff involved? If yes, what discount does the party receive for buying and accepting our terms? Are the vested tokens usable to participate in governance? All points that we have to consider.

Considering Point 3:

The DAO treasury currently sits at 27M API3 and loses about 18% of value each year at current inflation rates. Just considering that perspective we’d want to get some “bang for our buck” before the treasury is simply dilluted away. On the other hand, price is also something to consider and we don’t want to make our entire treasury available for cheap. Where is the right balance though?

What are we supposed to do?

In my opinion, selling portions of our API3 treasury in order to fund things is the only viable solution we have. The treasury is massive and suffering under inflation with nothing that we can do about it. The question is not really if we should sell but how. I see two viable options to go forward with this.

Option A: Make this a one-time event and raise enough ETH in order to tackle our liquiditiy issue. Option B: Create a solution that can be used for future sells as well (a.k.a a smart contract that sells portions of the funds it receives on the basis of a 10 day TWAP)

I have ideas for both, but would love to hear some community feedback before i go further into detail on what i have envisioned. No matter which path we go, i think the ultimate goal should be to use the funds that the DAO acquires by selling portions of API3, to pair liquiditiy of API3/ETH on Sushiswap in order to increase our liquidity on DEXes, while earning fees & SUSHI for doing so.

~just brainstorming – shoot your ideas ~

- Share CrocoBlock key trọn đời Download Crocoblock Free

- Cung cấp tài khoản nghe nhạc đỉnh cao Tidal Hifi – chất lượng âm thanh Master cho anh em mê nhạc.

- Background đảng

- Cách Fake IP trên máy tính để chơi game nước ngoài | GIA TÍN Computer

- Khóa màn hình iPhone bằng cách vuốt màn hình

- Cách phát Wifi trên Windows 10, chia sẻ wifi trên Win 10 không dùng ph

- Nhảy dây có làm to bắp chân? Lợi ích của tập nhảy dây là gì?

Bài viết cùng chủ đề:

-

Cách đặt iPhone/iPad vào chế độ DFU để khôi phục – QuanTriMang.com

-

Share Acc Vip Fshare 2018 – Tài Khoản Fshare Vip Tốc Độ Cao

-

[Update 2021] Cách giảm dung lượng ảnh trên điện thoại

-

Hướng dẫn cách lấy dữ liệu từ điện thoại chết nguồn

-

Cách cài Ubuntu song song với Windows 10, 8, 7 UEFI và GPT

-

Khuyến mãi hấp dẫn cho Tân sinh viên 2016 mạng Viettel

-

“Tất tần tật” kinh nghiệm mua vé máy bay bạn không nên bỏ qua!

-

4 cách định vị Zalo người khác đang ở đâu, tìm vị trí qua Zalo

-

Diện chẩn Điều khiển liệu pháp Bùi Quốc Châu

-

Top 3 phần mềm diệt virus miễn phí cho WinPhone

-

Sửa lỗi Full Disk 100% trên Windows với 14 thủ thuật sau – QuanTriMang.com

-

【Kinh tế tri thức là gì】Giải pháp phát triển Kinh tế tri thức ở Việt Nam

-

Chia sẻ tài khoản VIP hdonline gia hạn liên tục | kèm video hướng dẫn

-

Đăng ký cctalk, tạo nick TalkTV chat và nghe hát online

-

Cách máy bay cất cánh không phải ai cũng biết – Báo Công an Nhân dân điện tử

-

Top phần mềm kiểm tra tốc độ thẻ nhớ tốt nhất 2021